The Covid-19 crisis has put a huge burden on the global economy and could ultimately affect the economy more severely than the Great Financial crisis. European policy makers reacted to the crisis and intervened quickly in the real economy as well as in the financial markets, mainly by providing liquidity to the economy. So far European banks have weathered the storm, but will they be able to withstand a prolonged economic downturn? To examine the stability of European banking systems, our new study "The Corona crisis and the stability of the European banking sector" combines the latest economic forecasts with the results of the 2018 stress test of the European Banking Authority.

The latest GDP forecasts show that the downturn and recovery could be very different across EU countries. The forecasts also indicate that the current crisis might be worse than the Great Financial crisis. In contrast to the financial crisis, the Corona crisis is the result of an exogenous shock. While the GFC was characterized by contagion from the financial system into the real economy, the current crisis initially led to a major collapse of the real economy. In what way could this collapse in real economic activity undermine the stability of the banking system as part of the financial system?

Can European banks withstand the corona shock?

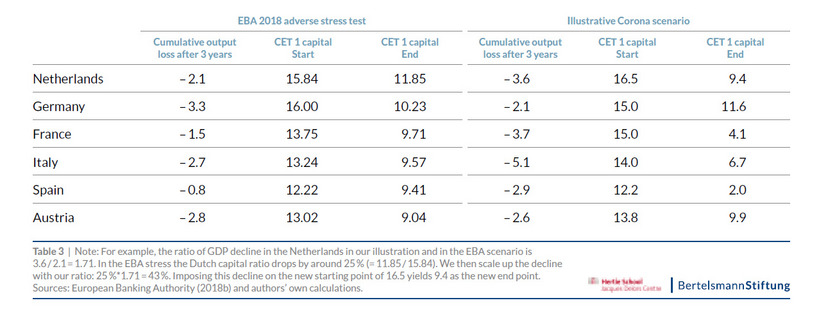

To assess this question, the paper compares the GDP developments under the baseline scenario and the adverse scenario of the Europe-wide bank stress tests of the European Banking Authority (EBA) from 2018 and the economic forecasts of the IMF in April 2020. The comparison shows that the level of euro area real GDP is predicted to shrink more than the EBA scenario in the first year of the crisis. In the second year of the crisis, the scenarios look quite similar. The picture differs in the case of Germany, as the forecasts for the second year are above the euro area average and above the EBA scenario. By contrast, forecasts for Italy and in particular Spain are significantly lower than what the EBA assumed for its test.

The effect of the Corona crisis on the banking sector mainly depends on the forthcoming economic recovery.

To assess the impact of the crisis on the stability of the banking system, illustrative impacts on capital ratios - one of the key benchmarks used to assess the stability of banking systems – are presented in a selected number of EU member states. Assuming the scenario that economies recover half of their 2020 losses in 2021 – a so called “thick-shaped” recovery - banks' capital will decrease steeply in parts of the euro area.